- States Where Online Gambling Is Legal

- Where Is Online Gambling Illegal

- List Of States Where Online Gambling Is Legal

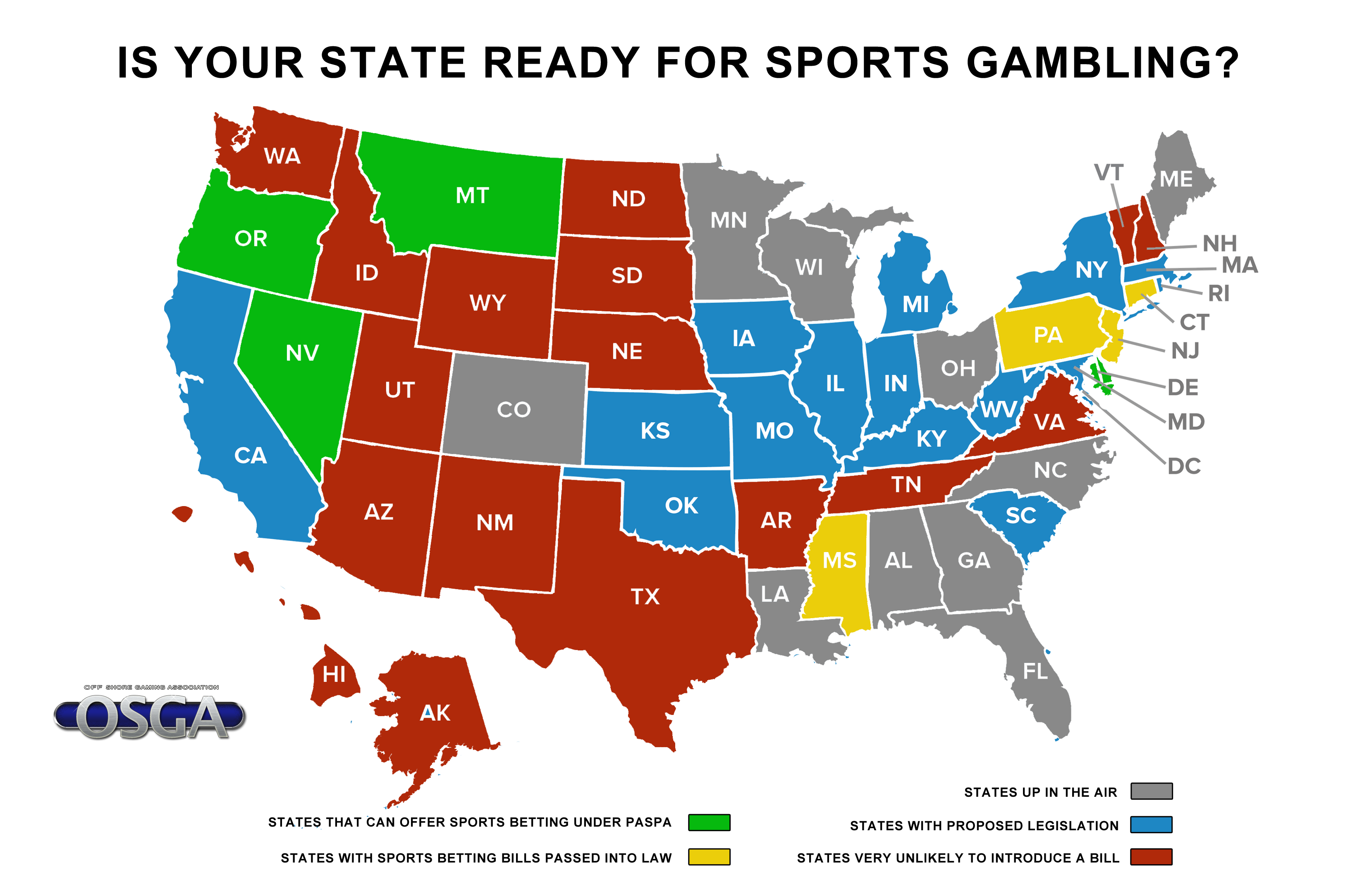

Where is online gambling legal in the U.S.? For online casino, you can gamble online in New Jersey, Delaware, and Pennsylvania. For online poker, you can legally play online in New Jersey, Nevada, Delaware and Pennsylvania. For online sports betting, you can gamble online in a number of states, and that number is growing every day. New Jersey, Nevada, West Virginia, Iowa, Indiana, New Hampshire. Most other states do not refer to online gambling in their laws, but Washington does. In the Washington gambling laws the state prevents all unregulated gambling activities, which also means online gambling. In 2006, the state of Washington created a law that criminalized online gambling. A 2011 legal challenge to that law saw the law upheld.

Four types of online gambling, including sports betting, could be operating legally in Michigan by March if Gov. Gretchen Whitmer, as expected, signs a package of bills sent to her Wednesday by the Legislature.

The Senate passed the bills by overwhelming and bipartisan votes early Wednesday afternoon. The House had already passed the bills, but had to concur with changes the Senate made to some of them before sending them on to the governor. That happened with all but one of the bills, which is expected to be sent to the governor early next year, and only deals with a penalty issue, not legalization itself.

How soon Internet gaming and sports betting would actually begin in Michigan would depend on a number of factors, including how long it takes to produce rules related to the legislation, how long licensing takes, and how soon licensed operators have technology in place, officials said.

'My hope is that by March Madness, it will be live,' said state Sen. Curtis Hertel, D-East Lansing, referencing the NCAA basketball tournament.

The following types of gambling would be newly legal:

Internet gambling

- The legislation legalizes Internet gaming, including poker, blackjack, slots, and other casino-style games.

- Internet gambling can only be offered by existing Michigan casinos, be they Detroit casinos or tribal casinos located around the state.

- Players must be 21 or older.

- Casinos operating Internet gambling will be subject to a $50,000 application fee, a $100,000 initial license fee, and a $50,000 annual fee. A license is good for five years.

- Those who supply casinos offering Internet gaming will have to be licensed and will be subject to a $5,000 application fee, a $5,000 initial license fee, and a $2,500 annual fee.

- The legislation creates the Internet Gaming Fund and requires fees and taxes to be paid into the fund.

- Online gaming would be taxed at between 20% and 28%, with the lowest rate applying to adjusted gross receipts below $4 million and the highest rate applying to adjusted gross receipts of $12 million or more. That tax rate is considerably higher than an earlier version of the legislation, which had a tax rate of 4% to 23%.

- To allow for free play to encourage Internet gaming, the casinos would be able to deduct 10% from the gross receipts, which would otherwise be taxed, for the first three years, 6% in the fourth year, and 4% in the fifth year. After that, no allowance is made for free play.

- Proceeds from the state tax on Internet gaming would be distributed as follows: 30% to the city in which the sports betting operator's casino is located, to be spent on policing and other public safety programs; 65% to the state's Internet Betting Fund, and 5% or up to $3 million annually to a fund to support and promote the horse racing industry.

- Money from the Internet Betting Fund could be used to cover administrative costs, with $2 million allocated to support first responders, $500,000 annually to combat compulsive gambling, and the balance going to the School Aid Fund.

Read the legislation: House Bills 4311, 4312, and 4323.

More: Legal internet gaming, sports betting nears final OK in Michigan: What will change

More: Senate votes to lift ban on political giving by casino interests

More: Sports betting legislation getting support from Michigan Indian tribes

Sports betting

- Sports wagering will be legalized and can be offered live or online by existing casinos.

- Sports betting will be taxed at a rate of 8.4%, with an extra 3.25% paid by casinos in the City of Detroit. That's down from a rate of 8.75% in a version the state House passed earlier.

- Proceeds from the 8.4% tax on sports betting will be divided as follows: 30% to the city in which the sports betting operator's casino is located, to be spent on policing and other public safety programs; 65% to the state's Internet Sports Betting Fund, and 5% or up to $3 million annually to a fund to support and promote the horse racing industry.

Read the Legislation: House Bill 4916, 4917, and 4918.

States Where Online Gambling Is Legal

Fantasy contests

- A Fantasy Contests Consumer Protection Act would regulate games in which players draft fantasy 'teams' composed of players from multiple teams in a given sports such as NFL football. Fantasy team owners then use scoring by those players in real games to compete in 'fantasy' games against other fantasy team owners.

- A fantasy contest operator would have to be licensed by the state, through the Michigan Gaming Control Board, but would not have to be a casino operator, as is the case with those operating online gaming and sports betting.

- Operators would be charged an initial fee of $10,000 and $5,000 annually for renewals. That's down from $50,000 for an initial fee and $20,000 for renewals, under an earlier form of the bill.

- Fantasy sports would be taxed at 8.4%.

- The legislation would not apply to home-operated fantasy leagues where participation is not available to the general public, there are no more than 15 participants, and no more than $10,000 collected in entry fees.

Read the legislation: House Bills 4308 and 4309.

Horse racing facilitators

Where Is Online Gambling Illegal

Would provide for the licensing of 'third-party facilitators' who could take bets on horse races electronically, in addition to the bets that can be placed on live or simulcast races at the track, under existing law.

Read the legislation: House Bill 4310 and Senate Bills 12 and 661.

List Of States Where Online Gambling Is Legal

Contact Paul Egan: 517-372-8660 or pegan@freepress.com. Follow him on Twitter @paulegan4. Read more on Michigan politics and sign up for our elections newsletter.